fidelity tax free bond fund by state 2020

All iShares ETFs trade commission free online through Fidelity. Tax on capital gains.

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

Credit Cards Insurance Mortgages Home Loans Credit Reports Scores.

. Despite the pandemic noting most state revenues were roughly flat in 2020 versus 2019. Prior to August 10 2020 market price returns for BlackRock and iShares ETFs were calculated using the midpoint price and accounted for. These returns may exceed before-tax return as a result of an imputed tax benefit received upon realization of tax losses and do not reflect the impact of state and local taxes.

All iShares ETFs trade commission free online through Fidelity. Returns for BlackRock and iShares ETFs are calculated using the closing price and account for distributions from the fund. Before buying a fund read its prospectus to determine whether interest from the fund is expected to be subject to federal state or local taxes.

Unless otherwise noted returns are adjusted for all applicable recurring and non-recurring fees including redemption fees loads and charges if any. For Equity Funds turnover rate is a measure of the funds trading activity calculated by dividing total purchases or sales of portfolio securities whichever is lower by the funds net assets. Bond Ratings Accessed Aug.

Morningstar rated the Lord Abbett Bond Debenture Fund class F share 4 4 and 5 stars among 275 237 and 135 Multisector Bond Funds for the overall rating and the 3 5 and 10 year periods ended 1312022 respectively. Fidelity calculates and reports the portion of tax-exempt interest dividend income that may be exempt from your state andor local income tax for the state-specific funds in the StateLocal Tax-Exempt Income from Fidelity Funds supplemental section of your Consolidated 1099 Tax Reporting Statement when applicable. No matter which investment company you use I still think Personal Capital is the best free app to help manage your Vanguard or Fidelity investments.

Prior to August 10 2020 market price returns for BlackRock and iShares ETFs were calculated using the midpoint price and accounted for. There are 2 ways investors could owe capital gains tax on a bond fund investment. Personal Capital automatically 1 tracks your investment performance 2 breaks down your asset allocation across all your accounts better than any tool Ive ever seen 3 reports on your fees to make.

Long-Term and the Debt-To-Equity Ratio on the Balance Sheet. Learn About the Benefits of Investing in Tax-Free Municipal Bonds. Returns for BlackRock and iShares ETFs are calculated using the closing price and account for distributions from the fund.

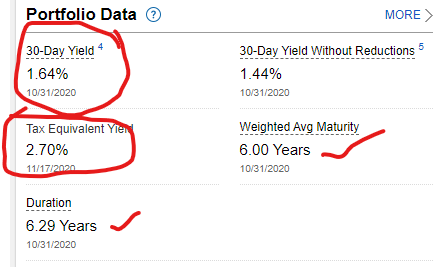

If the bond purchased is from a state other than the purchasers state of residence the home state may levy a tax. For the fixed income investments duration estimates how much a bond funds price will change with a change in comparable interest rates. These are some of.

Fidelity Dividend Growth Fund FDGFX 3716 offers this approach with a narrow list of about 150 large-cap dividend payers that the funds managers think are the best-equipped to deliver long. The fund is free from both federal income tax from the alternative minimum tax. Taxes by State Solving Tax Issues More.

Municipal bonds are free from federal taxes and are often free from state taxes.

Etfs Again Proved Their Worth To Taxable Investors In 2020 Morningstar Portfolio Management Investors Bond Funds

Share Buybacks Companies Buying Their Own Shares Fidelity Corporate Bonds Inflection Point Financial Engineering

U S Fund Flow Records Fell In 2020 Morningstar Bond Funds Corporate Bonds Fund